Key takeaways:

- Square is a pioneer in mobile payment technology. It came out with the first mobile card reader and has evolved into an ecosystem of business operations tools designed to serve businesses of all sizes.

- Square’s free pricing and flat-face payment processing structure are its biggest advantages, providing an all-in solution for merchants, especially Small Businesses looking to find Ways to Find Ways to keep the open

- Square Payments Lets Merchants Accepts A Variety of Payment Methods, Such as in-Person, Online, Mobile, Manual/Keyed-in, Inviced, and Recurring Billing.

Square is a widely popular and highly recommended point-off-wheel (pos) solution by experts and real-will users alike. It has featured in a lot of our pos buyer’s guides, mainly outing to its price point, suite of robust features, and low-cost fees and hardware options.

Read on to learn more about square as I tackle how it work, what it does, and how much it costs.

What is Square?

Square is a trailblazer in mobile card and payment technology, having the first mobile card reader in 2009. Ame with no fixed monthly costs and offered A free pos system. This innovation helped businesses take payments anywahere and completely changed the payment landscape in the retail industry.

Today, Square is more than a payment processor – it has evolved into a business technology platform serving all kinds of businesses. The Square Ecosystem Allows Businesses to Sell Anywahere, Manage Inventory, Communicate with Customers, Book Appointments, Order Online, and So much more. The square ecosystem has more than 36 products, Providing support and counstone options for any operation, from global chains to mom-g-pop shops.

Given the Incredible Value Square Provides and the Numerous Other Tools Besides Payment Processing It offers for free or at minimal costs, Square is the PEREFECT SOLATION FOR SOSSESS per month.

How Does Square Work?

Square primarily lets small businesses process payments through Credit Cards, Contactless Payments, and Ach Transfers. From this service, it then offers various tools with ecosystem that seamlessly work togetra and provide a complete business solution.

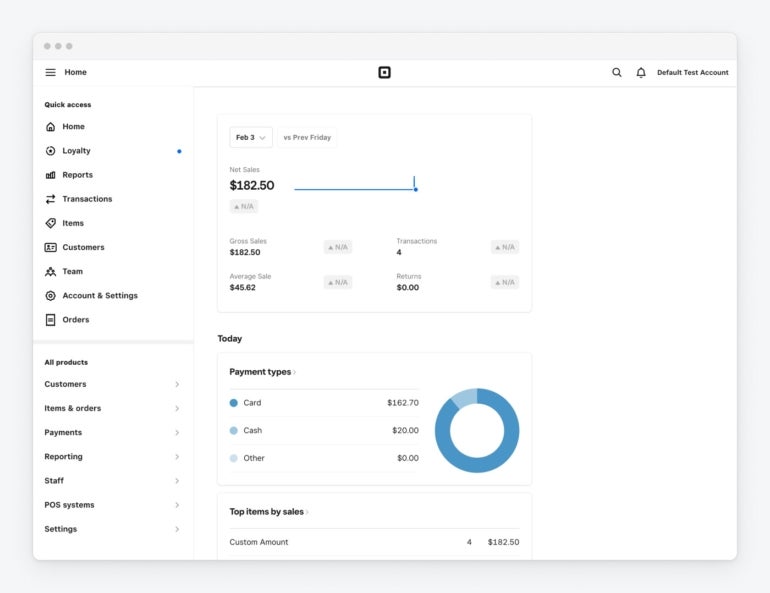

Essentially, Square Can Provide you with all the tools you need to run your business. Here are square products available within its ecoSystem:

- Payments: Mobile and in-Store Payments, Hardware, Vertical Terminal, Invocing, Chargeback and Dispute Management.

- Point-of-SALE (POS): Mobile and iPad Apps, Inventory Tracking, Reporting and Analytics, Customer and Team Management.

- Industry-specific pos: Retail (Square for Retail), Food and Beverage (Square for Restaurants), Services (Square Appointments).

- Online Ordering: E-Commerce (Square Online).

- Business Management: Payroll, email marketing, customer message (support), Loyalty Program.

- Banking: Checking Account, Savings Account, Debit Card, Small Business Loans.

What you get with square

Here are all the features you get with a free square account:

Pos

Square Pos Software Lets You Process a variety of payment methods, links to all your products, syncs your inventory, tracks your customer data, team members, and more Thrucks a few.

It enables you to accept the following payment methods: cash, check, vouchers; Credit and debit cards; Digital wallets, ach transfers, gift cards, buy now, pay later (BNPL) through afterpay; And Peer-to-Peer Payments Through Cashapp.

Square also supports the following Payment Services: Mobile Payments, In-Store Pos, Online Payment Gateway, Invocing, Recurring Payments, Virtual Terminal, and the CBD Program.

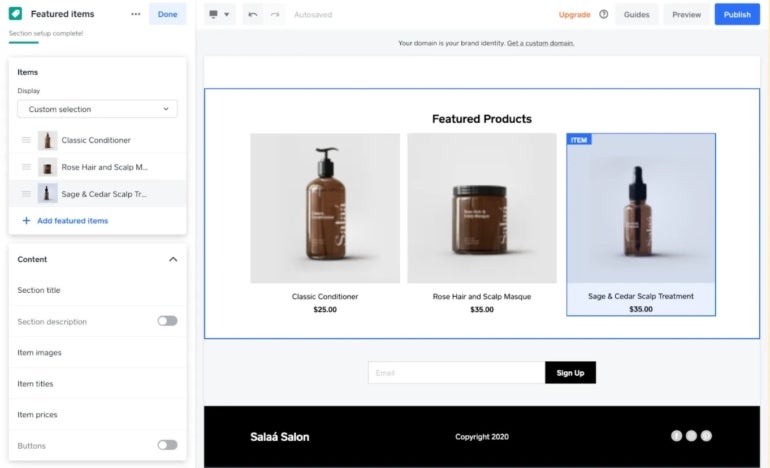

Online Store

When you sign up with square, you also get a free online store. Called Square Online, It Comes With An Easy-to-Use Website Builder and e-Commerce Platform That Allows You to take orders online. What’s great about square online is that inventory automatically syncs with square poses, allowing you to have real-time inventory tracking.

Square pricing

Take a look at the associateed fees with square’s point-off-side (pos, payment processing, and pos hardware.

Square pos pricing

Square pos software’s basic subscription is free, and any upgrades are bled months. The software works on Square Hardware and Mobile Devices – Divis, iPhone, Android devices.

Related:

Square Payment Processing Fees

Square’s biggest advantage over its competitors is its simple, flat-also payment processing, with no monthly fees. This means that square deducts a fixed percentage fee on successful payment transactions.

- Cash, cheque, vouches, and other tenders: $ 0

- In-Person, Mobile, and Gift Card Payments: 2.6% + 10 cents per transaction

- Online payments: 2.9% + 30 cents per transaction

- Recurring billing and card-on-file transactions: 3.5% + 15 cents per transaction

- Keyed-in Payments (Virtual terminal) transactions: 3.5% + 15 cents per transaction

- Ach bank transfers: 1% with a $ 1 minimum transaction

- Invoiced payments: 3.3% + 30 cents per transaction

- Afterpay: 6% + 30 cents per transaction

- CBD Program Transactions: From 3.5% + 10 cents per transaction

- Chargeback fee: Waived up to $ 250/month

Square pos hardware

To accept in-Person and Mobile Payments, Square Offers Various Low-Cost Hardware Options (Interest-Free Installment Plans are also available) to let you swipe, insert, or tap cards to complete. All hardware listed below work on smartphones and iPads using square’s free pos app.

- Square reader for magstripe: First free, additional reader $ 10

- Square reader for contactless and chip (2nd generation): $ 59

- Square terminal: $ 299 ($ 27/month with finance)

- Square Stand (2nd Generation, USB-C): $ 149.00 ($ 14.00/Mo with Financing)

- Square register: $ 799.00 ($ 39.00/Mo with Financing)

How long does square take to process payment?

Square lets you transfer funds from complete transactions to your bank account at varying speeds. By default, fund transfers are complete the next business day, and these are free.

Payments TAKEN BEFORE 5 PM, PT/8 PM, Et will be available in a merchant’s bank account the next business day. Payments Accepted on Friday Before 5 PM, pt will be posted to a merchant’s bank account by mode morning (Depending on your bank’s processing speeds).

Instant and Same-Day Payout Options are also available for an added fee-1.75% of the amount.

Square’s drawwbacks

Despite Planty of Benefits With Square, The Service Still Comes With Limitations and Drawbacks. Here are a less area square falls short of its competitors:

- Business Limitations: Square does not work with high-Risk businesses (Online Gambling, Age-Restricted Items, and More).

- Payment Processing Fees: Square’s fees are the lowest on the market, even thought it is very transparent with its flats flats. Square only gets you lower processing feet when you Reach $ 250,000 in Annual Sales. Other Providers, Such as Stripe and PayPal, May Offer Lower Fees at Lower Annual Sales Thresholds.

- Customer support: Square provides Limited Support Hours Outseide its Premium Plans and is Largely supported by online tutorials and chat. Real-wind user reviews also say that support is inconsistent as the level and quality you get highly depend on the agent you come into contact with.

- Account Stability: There are complaints on Third-party user review sites about Square’s account holds and freezes, which typically Occur when you have excess chargebacks or fruudulent charges. These issues take time to resolve and can have a big impact on business operations.

Related: 7 best square alternatives reviewed by experts

How to set up a square business account

To get started on using square, you need to sign up for a business account. Follow the steps below to set up a square business account:

Step 1: Choose your business structure. Square will ask you to provide information depending on your structure, which can be a sole proprietorship, Limited Liability Company (LLC), Private Company, Public Company, Public Company, PARTNERSIP, PARTNERSIP . Square has a list of requirements based on the business structure you will choose.

Step 2: Verify your personal identity. Financial Institutions like Square are governed by federal law and banking industry regulations, so they would need to verify and record information that Identifies Each Person Who OPENS ACCONS ACCONS

Step 3: Link your bank account. I recommend using a business bank account; Open one if you don’t have one coun.

Step 4: Set up transfer options. Square transfers are set to a next business day schedule by default. You can send instant or speak transfers for an additional fee.

Step 5: Log in to your square account on you are done with the initial setup. You can do this from the Square point of Sale App or your Square Dashboard (Web Browser).

Step 6: Order Square Hardware If You Sell In-Person.

Step 7: Create your product listings. Your Square Dashboard has an item Library where you can create, edit, and manage products.

Step 8: (Optional) Add Team Members (Employees) IF Needed. You can do this from your Square point of Sale App or Square Dashboard by Going to Staff> Team> Team Members, and Selecting Add Team Member.

Step 9: (Optional)

Also read: How to use square: an in-depth guide for new users

How to use the square payment system

As mentioned, you can use the square payment system to accept mobile, online, and in-store payments and even process manual payments and recurring payments. Below, I list the steps involved in processing mobile and in-face sales.

For mobile payments:

- Download The Square Pos Mobile App (iOS or Android) and Ensure you have the latest version.

- Sign in to your square mobile app.

- Connect Your Mobile Card Reader to Accept Tap, Dip, and Swipe Payments. Plug it on your phone or connect it via Bluetooth, depending on the card reader you have.

- Select items for the sale transaction by going to the item library in the mobile app.

- Once the items are chown, tap checkout, and when you are ready to accept the payment, tap charge.

- Select the customer’s chion payment method – SWIPE, TAP, or Dip; Cash, Keyed-in, Send Payment Link, QR Code, etc.

** You can process offline payments temporarily for 24 hours if you lose internet connection. Toggle allows from payments from Settings> Checkout> Offline Payments. The 24-Hour Window Includes uploading the payment data of your sale transactions. Once the window expires, the square app will not be able to collect the payments even.

For in-Person Payments:

- Order your square hardware of choice.

- Set up your pos app in your chion hardware by logging into your account and setting up your store.

- To log a sale, it will be similar to logging sales using the mobile app. Instead you will see the item library through a bigger screen.

- Collect payments through the square terminal or square stand/square mount. This step will be similar to mobile payments.

Frequently asked questions (faqs)

Is paying through square safe?

Yes, paying through square is safe. Its hardware and card readers have end-to-end encryption, and its software is PCI-Compiant. Its integrated payment system uses encryption and tokenizations and employs 24/7 fraud prevention on its servers, Protecting Data for Both Seller and Buyer.

How Much does Square Charge?

Square Charges a Fixed, Flat Rate for Credit Card Processing. In-Person Sales are charged 2.6% + 10 cents per transaction, while online sales are charged 2.9% + 30 cents per transaction.

Can I withdraw Money from Square?

Yes, you can transfer funds from your Square Account to Your Bank Account in Different Ways: Standard Next-Business-Day Transfer, Next Day, Instant. You can also set up intervals on when you want transfers to happy and this can happy automatically based on your set interval.

Does Square Process Recurring Payments?

Yes, Square Can. Square users can process recurring payments through the card on file feature on the square app, square invoices, and the online square dashboard.

Source link